There is always some uncertainty when trading charting patterns as you are working with probabilities. You can search for patterns by coin or pattern type. Here’s also a great chart pattern cheat sheet.

#Crypto bar chart how to

Some of the simple patterns like Support and Resistance breakout and approaches are among the most successful with win rates above 75%.Ĭheck out current trading chart pattern opportunities hereĬheck out video on how to trade an Ascending Triangle pattern.

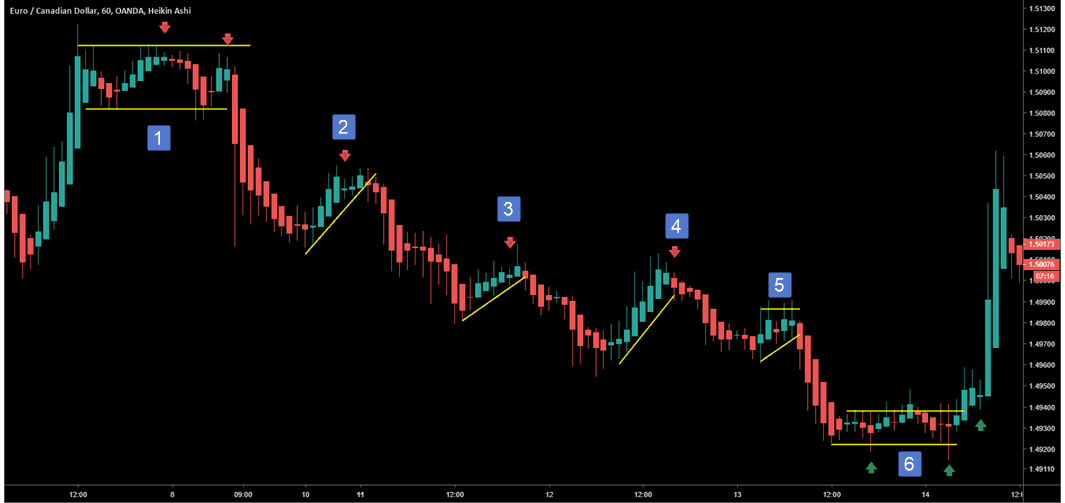

A breakout with little or no increase in volume has a higher chance of failing, especially if the move is to the upside. Hence, the increase in volume can confirm the validity of the price breakout. The subsequent move is likely to be substantial. Ideally, a price breakout (above a resistance or below support line) is accompanied by an increase in volume. Here is an example of a bullish Channel Up chart pattern:Ĭhart patterns often have false breakouts, therefore, traders can increase their success by confirming breakouts with other indicators (RSI, MACD, etc.) or even a simple volume trend. The system also clearly indicates the expected price path going forward, based on machine learning algorithms that crunched thousands of past situations.Ĭheck out current trading chart pattern opportunities here. Therefore, a pattern that develops on a daily chart is expected to result in a larger move than the same pattern observed on an intraday chart, such as a one-minute chart. Patterns that emerge over a longer period of time generally are more reliable, with larger moves resulting once price breaks out of the pattern. When price finally does break out of the price pattern, it can represent a significant change in sentiment. Price patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating chart patterns.

Head and Shoulders, Inverse Head and Shoulders.Overall Score of Oscillators (Oversold / Overbought)ĪltFINS’ automated chart pattern recognition engine identifies 27 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including:.Strong Up / Down Trend and Strong / Weak Ultimate Oscillator.Strong Up / Down Trend and Oversold / Overbought.Bollinger Band - Price Broke Upper / Lower Band.

0 kommentar(er)

0 kommentar(er)